When clients enter their financial advisors’ offices and express frustrations about a retail bank’s mistakes or overcharges, the damages are usually too small to merit any individual legal action.

“It’s $24 here and $45 there, and often there is very little you can do,” says Debra Brennan Tagg, managing director of Brennan Financial Services in Addison, Texas.

But, it is expected that when the Consumer Financial Protection Bureau issues its new regulations, the rules will allow for more class-action lawsuits targeting consumer finance companies’ misdeeds.

And Brennan Tagg and other financial advisors recognize that class-actions against retail banks may help some clients.

“I do think that class action is probably useful in egregious situations, where people have been harmed,” Brennan Tagg said.

NO MORE BANS?

Specifically, CFPB regulations are expected to prevent retail banks and other consumer finance companies from including mandatory arbitration in agreements that bar class-action lawsuits. Customers would still be expected to sign mandatory arbitration agreements, but those agreements would no longer bar class-action lawsuits.

Class-action plaintiffs frequently won big money against consumer finance companies before mandatory arbitration agreements barring such suits became de rigueur. After 2008, financial institutions began requiring customers sign such agreements. Subsequent U.S. Supreme Court decisions strengthened the enforcement of mandatory arbitration agreements and made it harder for consumers to file suit.

The Dodd-Frank Act of 2010 required the CFPB to study arbitration clauses in contracts for consumer financial products and report back. The CFPB’s regulations will be based on that 700-page report, issued in March 2015.

The report analyzed more than 1,800 consumer arbitration disputes from 2010 to 2012 and compared the relief won by consumers in individual arbitrations to that obtained by class-action members.

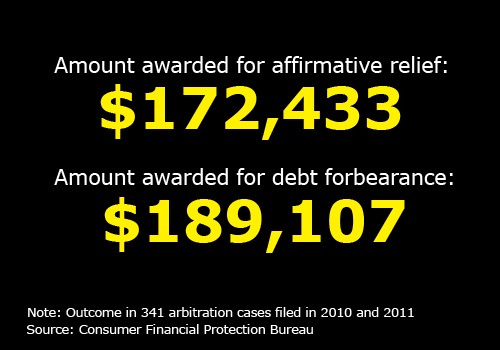

CFPB researchers were able to determine the outcome in 341 arbitration cases filed in 2010 and 2011. In those cases, arbitrators awarded a total of $172,433 for affirmative relief and $189,107 for debt forbearance. In class-action settlements for those same years, the CFPB researchers calculated the annual aggregate settlement amount on average was $540 million.

CFPB spokesman David Mayorga said the agency will soon publish a Notice of Proposed Rulemaking and seek public comment from all stakeholders; the first step in the rulemaking process. The agency said in October that it was considering rules that would require retail banks to submit arbitration claims and awards to the CFPB for approval. CFPB officials stressed no new rules have been finalized.

DRAWING FIRE

The report drew fire from consumer finance companies shortly after its release. The International Bank of Commerce sponsored a study by two law professors who found the report erroneously concluded that class-action settlements trumped arbitrations for supplying consumers with adequate damage awards.

The report did “not address the public policy question of whether, by resolving disputes more accurately on the merits, arbitration may prevent class action settlements induced solely by defendants’ incentive to avoid massive discovery costs,” the law professors said.

Moreover, the CFPB study’s aggregated average numbers reflect the results in “a very small number of massive class action settlements.” The report also failed to note when attorney fees in class-action settlements were larger than the payouts to plaintiffs, the professors said.

Still, some financial advisors are hopeful that settlements may help some clients, including one advisor who did not want his name used because his employer is owned by a parent company with retail banking operations.

‘FEEL HELPLESS’

About his own dealings with retail banks’ mistakes, he said, “I feel helpless when I get dinged with these small fees. I have no leverage or time to express myself about them. It’s frustrating that we can’t officially get rid of the disservices. It’s a pain and it doesn’t breed trust.”

Roger Mandel, a partner in the Dallas law offices of Lackey Hershman, who previously represented class-action clients against Wells Fargo Bank, predicted that within three-to-four years of the CFPB rule’s promulgation, the plaintiffs’ bar will “go back to the way things were” and vigorously pursue class-actions against finance companies.

For advisors, the CFPB’s timing comes just as the Certified Financial Planner Board of Standards announced it would require mandatory arbitrations for its members starting next month. The CFP announcement made clear that its members will lose their right to sue the board starting May 2; nor will CFP members be able to join class-action suits against the board.

Brennan Tagg welcomed the CFPB’s likely rulemaking saying it would help her clients in their complaints against retail banks. At the same time, Brennan Tagg, who recently took her exam and applied to become a CFP member, also welcomed the CFP’s decision to impose mandatory arbitrations.

“I think it is in the best interest of all. It’s a tough time for the CFP board to announce it, but there is a valid use for it,” she said.

Rich Arzaga agreed. The founder and CEO of Cornerstone Wealth Management in San Ramon, Calif., who also teaches financial planning at the University of California at Santa Cruz, Arzaga said, “I think it will be efficient.”

He recognized the CFP’s decision may ultimately mean advisors will have less access to documents and trial transcripts that show what took place in other disputes, but believed the hassle of litigation outweighs any concerns about the lack of transparency.

“I don’t like litigation; it takes too much time and money,” he said.

Source: www.financial-planning.com