ST. LOUIS, Mo.–(BUSINESS WIRE)–Schlichter, Bogard & Denton, a leading national law firm based in St.Louis, today filed separate class action lawsuits against threeuniversities on behalf of over 60,000 employees in their definedcontribution retirement plans.

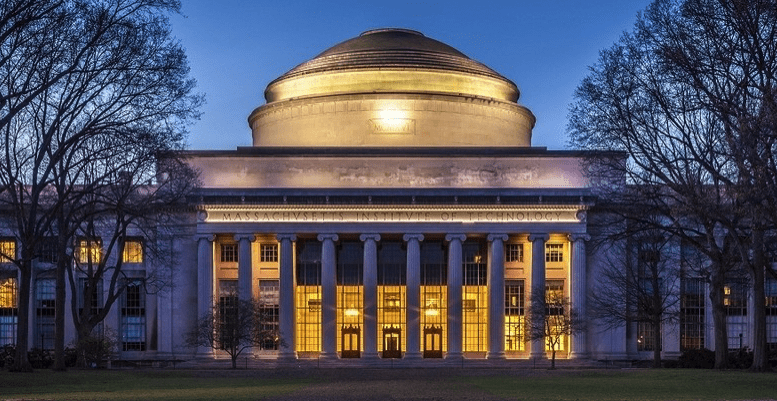

The complaints, David B. Tracey, et al., v. Massachusetts Instituteof Technology, et al.; Dr. Alan Sacerdote, et al., v. New YorkUniversity, et al.;and Joseph Vellali, et al., v. YaleUniversity, et. al., were filed in the U.S. District Courts ofMassachusetts, the Southern District of New York, and the District ofConnecticut, respectively.

“We contend that these universities, as fiduciaries, have breached theirduties under the law to protect the retirement assets of their employeesand retirees,” Jerry Schlichter of Schlichter, Bogard & Denton, theattorney for the plaintiffs stated. “These university employees deservethe same right to build meaningful retirement assets as employees offor-profit companies,” Mr. Schlichter added.

Common to all three complaints are allegations that each of theseuniversities, as employee retirement plan sponsors, breached theirduties of loyalty and prudence under the Employee Retirement IncomeSecurity Act (ERISA) by causing plan participants to pay millions ofdollars in unreasonable and excessive fees for recordkeeping,administrative, and investment services of the plans.

The complaints further allege that the universities breached theirfiduciary duties by selecting and retaining numerous high-cost and poorperforming investment options compared to available alternatives, whichsubstantially reduced the retirement assets of the employees andretirees.

In the cases of New York University and Yale University, both 403(b)type plans, the complaints allege employees paid excessive recordkeepingfees in addition to selecting and imprudently retaining funds whichhistorically underperformed for years.

The complaints also state that in contrast to actions by prudentfiduciaries of other similarly sized defined contribution plans, theseuniversities each used multiple recordkeepers, rather than a singlerecordkeeper. Consequently, by using multiple recordkeepers, theuniversities caused plan participants to pay duplicative, excessive, andunreasonable fees for plan recordkeeping services.

In the case of Massachusetts Institute of Technology, a 401(k) plan, thecomplaint alleges that MIT’s close relationship with FidelityInvestments led to its selection as plan recordkeeper, without anycompetitive bidding process in violation of the university’s duty to actin the exclusive interest of its employees and retirees according to thecomplaint, Abigail Johnson has been a member of the MIT Board ofTrustees for years and is also CEO of Fidelity, which her familycontrols. It also alleges that MIT placed over 150 Fidelity funds,including high priced retail funds in the plan, in spite of the planbeing a $3.5 billion plan able to command lower fees. This has causedparticipants to pay unreasonable administrative and investmentmanagement expenses.

“The universities do not have high priced retail mutual funds in theirmulti-billion dollar endowments, yet they have them in their employees’retirement plans, resulting in the employees paying excessive fees anddiminishing their retirement savings,” added Mr. Schlichter.

Schlichter, Bogard & Denton, based in St. Louis, MO, pioneered excessivefee 401(k) litigation on behalf of employees and retirees and to seekremedies. Since 2006, the firm has filed 20 such complaints and secured9 settlements on behalf of employees. In 2009, the firm won the onlyfull trial of an 401(k) excessive fee case against ABB. The firm’s Tibblev. Edison is the first and only 401(k) excessive fee case to beargued in the Supreme Court. On May 18, 2015, the firm won a landmarkunanimous 9-0 decision in which both the AARP and the Solicitor Generalwrote supporting briefs for the employees.

Jerry Schlichter and his firm have been referred to by federal judges as“preeminent “in the field of 401(k) fee litigation; as demonstrating“extraordinary skill and determination”; as making “a significant,national contribution,” having “educated plan administrators, theDepartment of Labor, <and> the courts” about fees and fiduciaryobligations; and has been referred to by federal judges as a “privateattorney general,” causing fees to come down in the entire 401(k)industry.

About Schlichter, Bogard & Denton, LLP

Schlichter, Bogard & Denton, LLP, of St. Louis is a national law firmthat represents individuals, including victims of financial abuse and401(k) plan investors, whose plans suffer from excessive fees orimprudent investment options. Its attorneys are dedicated to helpingfinancial abuse victims, and helping employees and retirees secure theretirement benefits they deserve.

More information can be found at:

http://www.uselaws.comor call (800)-USE-LAWS (873-5297)