Some taxpayers in the Indian Hill Exempted Village School District have expressed frustration about their options in a recent property tax settlement.

As part of a $5.5 million payment to taxpayers and attorneys related to the settlement of a property tax lawsuit, residents have been given an option to receive a check or donate the money to the Indian Hill Public Schools Foundation.

The $5.5 million was awarded in a class action settlement approved by Hamilton County Court of Common Pleas Judge Steven Martin last year.

The property tax lawsuit was tied to an inside millage decision made by the school board in 2009 which permitted the board to move 1.25 mills of inside millage to fund permanent improvements.

A group called the Committee for Responsible School Spending contended the move was unnecessary since the district had an estimated $24 million in cash reserves at the time. The committee aggressively fought the decision eventually taking the matter to the Ohio Supreme Court.

The Supreme Court ruled that the additional revenue from the outside mills was not required.

The committee later filed a lawsuit with the Court of Common Pleas.

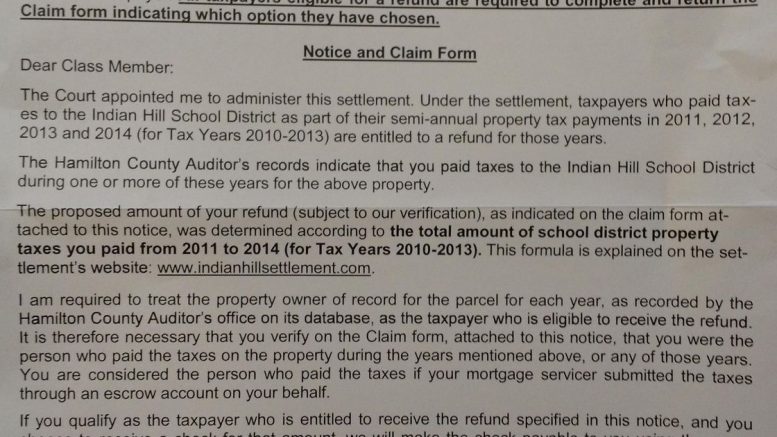

The court approved settlement provided two options. A district taxpayer who is notified of a refund amount may accept it as a check or they can donate that amount to the Indian Hill Public Schools Foundation, an independent, nonprofit organization.

Some residents have argued whether this is appropriate, saying that essentially this is giving the money back to the district.

“I don’t think that any entity of the district should benefit from the inside millage that was wrongfully taken,” Indian Hill resident Lisa Braverman said. “While I appreciate the foundation, any solicitation of the taxpayers should be independent of this refund.”

This sentiment was echoed by Indian Hill resident Susan Wisner.

“I think it is in questionable taste for any part of the Indian Hill schools, including the foundation, to continue to attempt to gain access to the funds that were illegally gotten in the first place,” she said.

John McClure, president of the Indian Hill Public Schools Foundation, said the foundation was not even aware that it could potentially be a recipient of these funds until the settlement was announced.

“This is something the (school) board and litigants had discussed,” he said. “That being said we think it’s a great opportunity. We are extremely pleased the litigants agreed to put this in their settlement.”

The Indian Hill Public Schools Foundation is a 501 (c) (3) nonprofit organization that serves as “a support group” for the district, according to their mission statement.

“Any of this money we get back we are putting in a separate fund called the Braves Forever Fund,” McClure said. “It will be used directly for the grants and projects the foundation implements in the future.”

However, Mary Siegel, who is a member of the Committee for Responsible School Spending and was also a litigant in the lawsuit, said the settlement statement enclosed with the claims form issued to the property owners may lead some to believe it’s an either/or proposition – receive a check or donate the money to the Public Schools Foundation.

“That doesn’t mean you can’t give (the refund) to another organization,” she said. “You can give it to another tax deductible charity, and it would have the same tax effect as if you gave it to the foundation.”

Siegel said the Committee for Responsible School Spending has proposed using the refund as a donation to the 1851 Center for Constitutional Law.

The 1851 Center, which is a nonprofit legal center, served as legal representatives for the Committee for Responsible School Spending.

“They took our cause pro bono, and without them we would never have been able to go anywhere with this,” she said.

Indian Hill schools Superintendent Mark Miles said it is ultimately up to the taxpayer on how he or she wants to use the refund.

“The taxpayers have a choice on how they can direct those dollars,” he said.

Source: www.cincinnati.com