Lawsuit Seeks Up to $200 Million in Water Billing Error

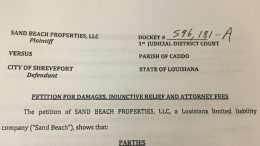

A lawsuit has been filed against the City of Shreveport related to the water rate billing error that cost the city about $1 million of ratepayer generated revenue over the past year. Sand Beach Properties LLC filed a lawsuit …