Is 401(k) fee litigation over? Now that many of the cases contending that large 401(k) plans paid too high fees have been settled or decided, it would be tempting for plan sponsors that haven’t been sued to breathe a sigh of relief. They should not do so, because litigation continues unabated with new theories and targets.

Are the targets just Walmart- and Fidelity-sized? Not anymore. Two lawsuits were recently filed against fiduciaries of plans with assets of about $25 million, though one has been withdrawn. Practitioners worry this may be the start of a spate of suits against fiduciaries of smaller plans. The targets have also been weighted toward plans that include proprietary funds in their lineups, a practice which has been fairly common.

Proprietary funds are not just an issue for the Fidelity, Vanguard and Principal plans that cover their own employees; sponsors who establish plans with prototype providers often feel pressure to include the provider’s own funds in their lineup regardless of whether they are the best in their class and need to evaluate their exposure if they select these funds.

Here is a summary of some of the suits and the arguments plaintiffs make where participants are overpaying for services:

· Great-West Life and Annuity Insurance is being sued in a class action lawsuit based on its operation of its stable value fund. Plaintiffs claim Great-West’s ability to set interest rates enabled it to increase profits at the expense of plan participants.

· A current lawsuit involving the fiduciaries of a $25 million Checksmart Financial plan targets investment adviser Cetera Advisor Networks.

· Plaintiffs, including those in the Checksmart complaint, argue that a menu of index funds should be provided in every 401(k) plan. The Checksmart complaint and other suits contend that 401(k) plans should only look to index funds as actively managed funds do not outperform index funds; Investment professions will dispute the generalization that the decision to provide actively managed funds is imprudent.

· Any plan that includes a sponsor’s own proprietary funds that have higher fees or are not at the top-ranking in performance for their class is at particular risk. Plans that cover the provider’s own employees always raise self-dealing charges. Fiduciaries have operated the plan to receive management fees from the investment of plan assets in their own funds, even when the investments are not in the interest of the participants. Suits have recently been filed regarding the plans New York Life Insurance Company and American Century Investments provide their own employees.

Plaintiffs continue to argue that discretion to set fees in the form of adjustments under contracts, such as Great-West setting the interest rate participants receive, makes providers fiduciaries, even though they have not been succeeding with this argument when cases actually go to trial.

Where does this leave 401(k) fiduciaries who haven’t yet been sued? There is more reason than ever for them to adopt fiduciary best practices with regard to plan fees. Here are a few suggestions:

· Hire a co-fiduciary investment adviser or a fiduciary investment manager if you don’t already have one. Few plan fiduciaries have the time or expertise to evaluate fund choices, but experts familiar with the market can help you determine which funds are really the best and make sure you have a suitable mix of asset classes available. An investment manager can even make the decisions for you if you are willing to delegate control. Don’t wait for the new fiduciary regulations to come into effect if you rely on a broker who hasn’t accepted fiduciary status for advice about your investment menu.

· Don’t set it and forget it. The U.S. Supreme Court has said investment responsibilities are ongoing, and fund performance and fees can change over time.

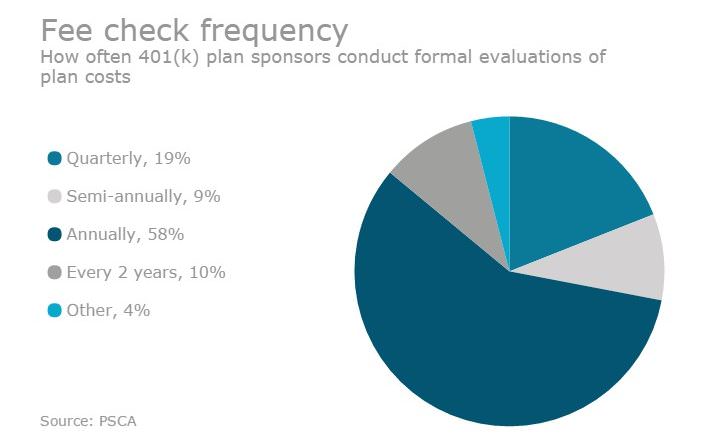

· Benchmark fees and do RFPs on a regular basis to evaluate your fees. You can often use RFP results to negotiate with your current provider for lower fees if you are otherwise satisfied with your current provider.

· Evaluate share classes and revenue sharing arrangements to get the best deal for your participants.

· Consider adopting a formal fee review policy, setting out the standards to be used by plan fiduciaries. These are becoming more common. If you don’t have one, at least make sure your investment policy statement includes provisions dealing with plan fees.

One final bit of advice: If you are sued despite having taken these steps, have adequate fiduciary liability insurance in place. Lawsuits are expensive even if you win.

The right financial wellness solutions can foster engaged, loyal employees

Partner Insights

Sponsor Content From:

Carol Buckmann is a partner at Cohen & Buckmann PC.

Source: www.benefitnews.com

Be the first to comment on "Lawsuits Bring 401(k) Fees Into Question"